| The Mercator International Opportunity Fund Q1 2023 Report | 您所在的位置:网站首页 › disproportionally represented › The Mercator International Opportunity Fund Q1 2023 Report |

The Mercator International Opportunity Fund Q1 2023 Report

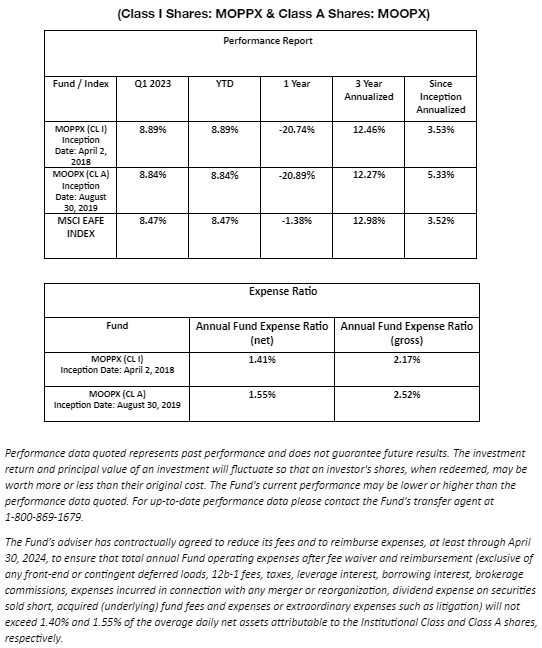

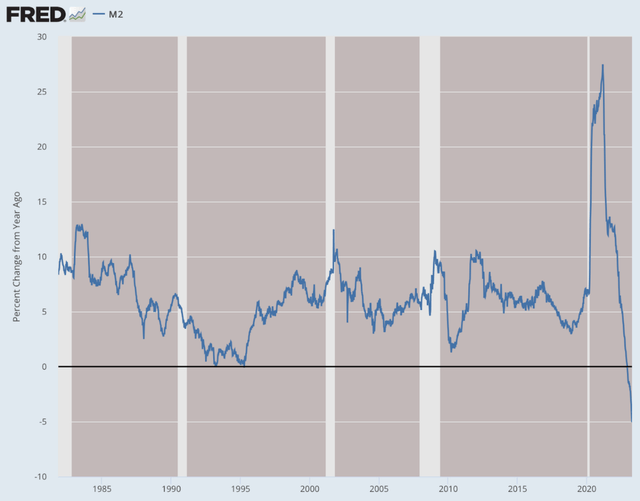

Tatiana Dyuvbanova  Q1 2023 Performance Chart (Mercator Investment Management) Relative calm has returned to markets, for now. After three years of turmoil caused by the pandemic, the war in Ukraine, and aggressive monetary policies, market volatility has subsided. Stocks’ fundamentals are taking precedence to macro-economic events again.  personal In the aftermath of the COVID-19 outbreak, global markets were flooded with money. Lockdowns triggered unprecedented fiscal and monetary stimuli in order to prevent businesses and people from going bankrupt. Low interest rates meant that large amounts of newly printed money sought returns in risky assets. Cheap and abundant money fueled speculative investments in rapidly growing companies, some of which were profitable, some were not. Many were beneficiaries of the digital revolution. Lockdowns gave the digitalization of the economy a huge boost. The world went virtual overnight. Everybody had to work, invest, entertain, and shop online. Demand for stocks of semiconductors, computers, e-commerce, or video games all shot up. A buying frenzy quickly produced a new tech bubble. We all know how it ended. Inflation kicked in, and, after a moment of hesitation, the Fed aggressively hiked interest rates. Since low interest rates are perceived to benefit growth stocks disproportionately, higher rates triggered a knee-jerk sell-off of growth stocks. Interest rates determine the net present value of future earnings. The lower the discount rate, the higher the value. And vice versa. Ultimately, math 101 tells us that the net present value of future earnings is infinite when interest rates reach zero. The Fed did not go that far but got pretty close to making money free. Speculators seem thus to have been justified in pushing valuations of some tech stocks to absurd levels.  (Data: Federal Reserve Economic Data [FRED], St. Louis Fed; Chart: Jeffrey A. Tucker) (fred) Unfortunately, good things never last. When the Federal Reserve Bank reversed its policy of cheap money, very overbought stocks—the tech or “disruptive” companies—came down hard. It was predictable. What we did not anticipate is the sale of just about all growth stocks across the board, no matter their valuations or growth prospects. Steady, non-cyclical growth companies, whose stocks had not been overbought at all, often saw their valuations cut in half. The Role of ETFsThe recent extreme volatility in markets was compounded by a relatively new product: the sector Exchange-Traded Fund, or ETF. The popularity of sector ETFs comes from the fact that they trade like stocks as opposed to mutual funds which can only be bought or sold at the end of the trading day. There is unfortunately a negative side effect to such stock-like funds. Every inflow of money has to be immediately invested in all the underlying holdings, without consideration of valuations or marketability. Fresh money is put to work instantly and indiscriminately all day long in order to keep the ETF’s holding percentages constant. This has important and unintended consequences. ETFs’ blanket sector buying pushes mediocre companies’ value up as well as their better peers’. Furthermore, if a company’s stock is less liquid, the ETF’s blind buying—based as it is on each stock’s market weight in the sector index, not marketability—will tend to push its price up disproportionally with no regard to quality. The resulting overvaluation of weak or so-so companies can be spectacular. Conversely, when money flows out, it is hard to sell illiquid names so prices drop with a vengeance. ETFs have no choice but to throw the babies out with the bathwater. The US PremiumA rotation into value should benefit international markets. Since the 2008 financial crisis, where all markets dipped to around 10 times earnings, the US market has continuously traded at a premium to the rest of the world. Even the sharp correction of tech stocks has not reduced the large gap. Today, the S&P (SP500) is trading at 18.8 times forward earnings versus the Morgan Stanley international EAFE index’s 13.3*. We don’t think this is justified or sustainable in the long run. Investment opportunities abroad continue to be overlooked, which we believe offers good investment opportunities. Eventually, investors will notice. Globalization is on the retreat, but the world is not standing still. Europe has surprised by shrugging off last year’s energy crisis. The shock caused by Brexit is now past and the UK is mending fences with the European Union. Japan is using global inflation to finally get out of its decades-long deflation. Staying The CourseThere has been very little variation in most of our companies’ business outlook. Despite that, huge variations in how much investors are willing to pay for the businesses persist. We have been actively taking advantage of some of this mispricing. We have added to positions when selling seemed unjustified and excessive. We also took advantage of the overall weakness in growth stocks to make some new acquisitions, of which Nemetschek (OTCPK:NEMKY, OTC:NEMTF, NEM:GR; 2.42%) is an example. Nemetschek, a German software company, is Europe’s leading provider of software solutions for architecture, engineering and construction. Their biggest competitor is California’s Autodesk (ADSK). The stock had been on our radar screen for a long time, but always seemed overvalued. Like so many growth stocks, Nemetschek’s valuation reached stratospheric levels before dropping more than 50% in the big rotation out of growth. Finally, we were able to buy at an attractive price. Elsewhere, we started to build a position in MercadoLibre (MELI; 6.97% ) last year after the stock had corrected to $1,200 from a high of $2,000. A darling of growth investors, MELI is often referred to as the Amazon of Latin America. At $1,200, MELI traded at a reasonable 5 times revenues, not demanding for a company growing at more than 50%. Even so, the stock resumed its downward trend. We kept adding all the way down to $600. Eventually the stock bounced back to end last quarter at $1,318. The holding has grown to almost 7% of the portfolio and represented our biggest position at the end of March. Pundits refer to markets being “risk-off” when growth stocks are being sold. But in turbulent times, true winners emerge from the pack. Merely “okay” companies, even those in sexy-sounding businesses, will lag. When companies’ performance remains strong or even improve under stress at the same time that market volatility brings their prices down to bargain levels, we enjoy “good pickings” indeed. Hervé van Caloen, CIO *https://www.yardeni.com/pub/mscipe.pdfEditor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. |

【本文地址】